What's New for 2021 - Canadian Taxes

Feb 21, 2022

Stay up to date with the latest for your Canadian tax return for 2021

Here are the some of the changes specific to COVID that you should be aware of:

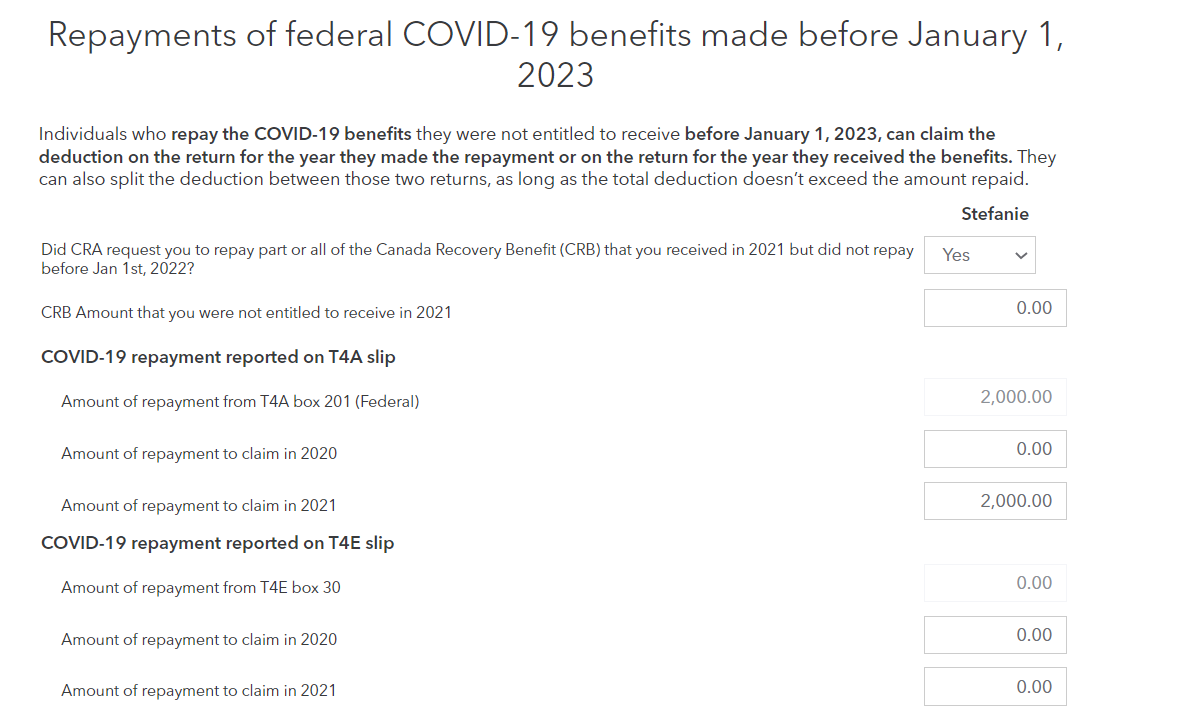

COVID-19 benefit repayment - If you repaid all or part of COVID-19 benefits received in 2020 or 2021, you're able to choose the year to deduct the repayment amount. You should receive a slip reporting repaid amounts for EI (T4E) as well as CERB, CRB, CRCB, and CRSB benefits (T4A).

*You must select the year to claim the repayment

Work-from-home expenses - If you had to work from home due to COVID-19 closures in 2021, you're able to make claims in the Employment Expenses section on forms T777 or T777S, under the same rules introduced in 2020.

Provincial COVID-19 assistance - One-time provincial payments to help you through COVID-19 are not taxable and should not be reported as income on your 2021 tax return.

There have been some general tax changes as well to consider:

Disability Tax Credit - The eligibility requirements for this non-refundable credit have expanded to include an updated list of mental functions of everyday life, a longer list of activities in determining time spent on life-sustaining therapy, and reducing the minimum required frequency of therapy.

If you have questions about qualifying for the DTC, I will be delivering a seminary with CPA British Columbia March 3rd, register here: Register Here

Northern Residents Deduction - The travel component of the Northern Residents Deduction has been made available to residents with no employer benefits.

Eligible educator school supply tax credit - Beginning in 2021, the eligible educator school supply tax credit has increased to $250 from $150.

Canada Workers Benefit - The Canada Workers Benefit has been updated with increased amounts and will now be available to more individuals. Also, the secondary earner exemption was introduced for individuals with an eligible spouse.

There have been some provincial tax changes as well to consider:

The Seniors' Home Safety Tax Credit - This new credit supports seniors in making their homes safer and more accessible, with a credit of 25% up to a max $10,000 in eligible expenses.

Childcare Access and Relief from Expenses (CARE) Tax Credit - For tax year 2021 this credit will be increased by 20%.

Temporary Ontario Jobs Training Tax Credit - This new credit allows individuals to claim 50% of eligible expenses for 2021 to a max credit of $2,000.

Ontario Apprenticeship Training Tax Credit - This credit has expired for tax year 2021.

Have questions? Contact me, happy to help!

Ready to take a hold of your finances and learn how to do your own taxes? Don't forget to register for my TurboTax for Beginners launching Feb 28, 2022 on-demand.